How to Fix Stop Loss for Investment Stocks?

In a Monthly Chart take the previous BH<50%CH Candle and place Stop Loss @ one ninth (1/9th.) below the Low of this Candle for the next month Stop Loss. Do it as a one-time activity at the close of every Month.

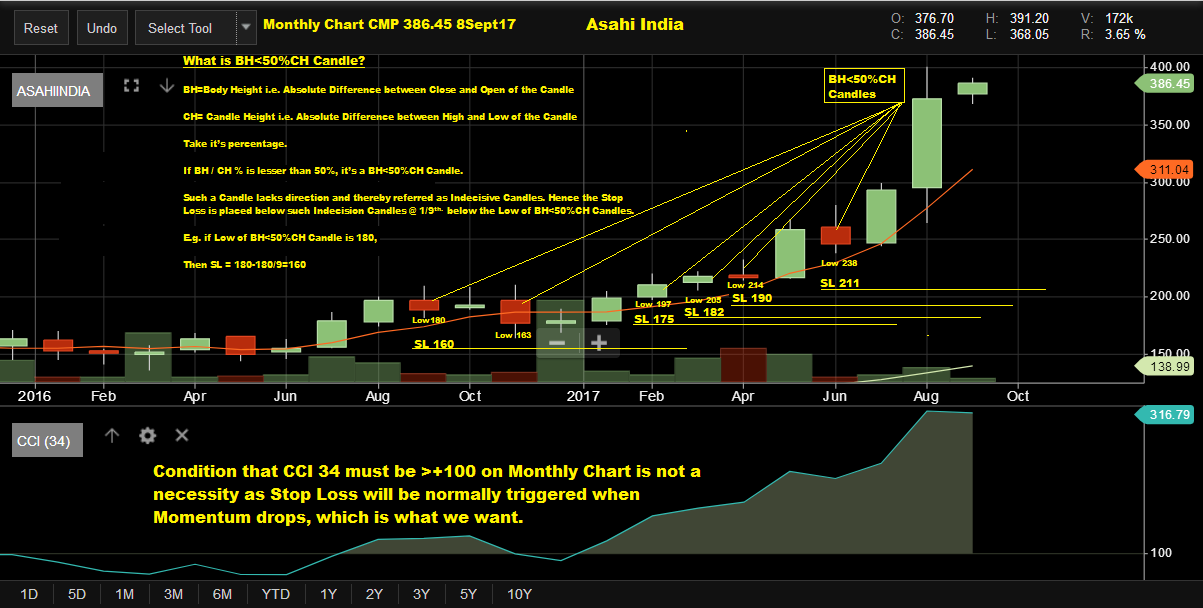

Here is the Simplified Illustration for Asahi India as a Case Study.

Here the Condition that CCI 34 must be >+100 on Monthly Chart is not valid or a necessity as Stop Loss will be normally triggered when Momentum drops, which is what we want.

If you are not aware how to analyze a BH<50% CH Candle, here is it

What is BH<50%CH Candle?

BH=Body Height i.e. Absolute Difference between Close and Open of the Candle

CH= Candle Height i.e. Absolute Difference between High and Low of the Candle

Take it’s percentage.

If BH / CH % is lesser than 50%, it’s a BH<50%CH Candle.

Such a Candle lacks direction and thereby referred as Indecisive Candles. Hence the Stop Loss is placed below such Indecision Candles @ 1/9th. below the Low of BH<50%CH Candles.

E.g. if Low of BH<50%CH Candle is 180,

Then SL = 180-180/9=160.

Refer blog post:

Breakout or Strength Candles

Non-Breakout Candles

How to Fix Targets for Investment Stocks?

While there are many other ways to arrive at Stop Loss, this is one of them.

Comments Clarification are Welcomed.

9Sept17 20:10

STOP LOSS STOCK

Leave a Reply