DTR & Low Margin Cash Trading

Daily True Range (DTR) as will be commonly referred here onward is in short the Difference between High and Low to the Open of the Day.

Daily True Range has its importance in Day Trading where trades have to be squared-off by end of Day.

It revolves around trying to gauge if there is any scope for further intra day rise or fall in the direction of trade.

It starts with noting the day’s High and Low and the difference as a percentage to Open of the Day.

It is a foot rule guide for measuring price flow in terms of percentages that can relate well to the percentage margin one pays for a trade.

It can help in deciding at what stage of momentum one can assume that the best of the rise or fall has occurred.

Every day a Stock or an Index may have its own milestones, occurrences and a few events that may term it as an Event Day.

At some juncture every day must know depending on what is High and Low Difference as a percentage to Open whether it is an Event Day or a Non-Event Day for the Stock.

The DTR differs on Event Days like Corporate Results and other wise on Non-Event Days.

DTR – Day’s True Range, is Difference between High and Low of the day as a percentage to Open Price.

Namely in Intra Day we follow:

DTR – OR i.e. Open Range. It is the DTR at the end of Open Range of first 15 of a Day.

DTR – OR therefore is Difference between High and Low of the day till the Open Range ends at 9:30am as a percentage to Open Price.

DTR – OR appears circled in yellow at left just above the first three candles of 5min for the day that form the Open Range. The percentage has a significance. It must not exceed 0.76% for a stock to allow scope for trading gains later. On the right corner is the DTR in Value and Percentage updated at every tick throughout the day and at the close of the day it reveals the DTR Value and Percentage at the close of day.

As the day progresses next comes the Breakout from the Open Range High or Low with a valid Breakout Process.

DTR at the time of Breakout is DTR – B

In the example, you will observe DTR – OR as 0.93% and DTR – B at 1.47% and DTR by close of day at 3.13% at extreme left top corner.

Depending upon the DTR-B, a trader can decide likely DTR Left (DTRL) which is the possible scope left in percentage terms of a likely further price flow provided DTR Average as per margin is known.

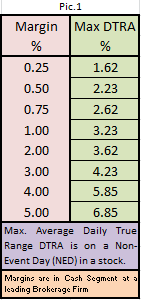

DTRA is the Average of Maximum High-Low Difference recorded over the nearest past few months based on Liquidity and Volume of transactions and such average is adjusted to nearest Fibonacci values as in Pic.1

Depending upon Margin for the Stock, DTRA varies and is directly proportional as in Pic.1

Margins vary from 0.25% to 5% in Cash or Spot and accordingly the average Max DTRA on a Non-Event Day (NED) is as shown in Pic.1

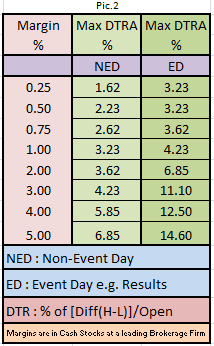

However on Events Days (ED) with results or any other announcements by the company, stocks tend to exhibit more volatility.

Like in the case of SBI with 0.5% Margin the stock that may show DTRA of 2.23% on NED days as per table but may be more volatile and have range to the extent of two levels higher of up to 3.23%.

A table with DTRA on both NED & ED Days in Pic.2

DTRL as referred earlier is the possible scope left in percentage terms of a likely further price flow in the direction of trend and therefore

DTRL = DTRA – DTR

For example if you wish to Enter in a Trade in 0.5% Margin stock HDFC Bank which has probability of High to Low Difference % of 1.62% on NED and at the time of Entry the DTR achieved was 0.54% then balance of DTR Left (DTRL) is 1.08% which can be sizeable as Margin is 0.5%.

A Ready Reference Google Document https://docs.google.com/spreadsheets/d/1BgUI20NXXRWSAhwTpi4bWFrrYk8-X6WP9rtVR68DOdw/edit#gid=0

is available that updates every 5-10secs on DTRL and DTR done with Targets on Upside and Downside calculated based on DTRA.

Depending if DTRL is sizeable one can Enter a Trade.

In the second part we will take up Margins and Exposure depending upon Proximity of Stop Loss even touching on RR & Return on Margins(ROM’s)

Your queries may be posted.

NIFTY MARGIN TRADING CASH EXPOSURE STOP LOSS TRUE RANGE ATR DTR

Leave a Reply