Breakout or Strength Candles

BREAKOUT CANDLESTICK ANALYSIS CANDLE

What is the Importance of Open and Close in a Candlestick Analysis?

Very simply, it encompasses the Body of the Candle. It defines, generates and gives shape to the Body of the Candle which goes on to summarize the day into Strength or a Weak Candle.

Here’s how we can arrive at Body and Candle Height and decide on the type of Candle either a Strength Candle or Weak Candle.

To the extent of the Body Height of the Candle to the Candle Height it conveys whether the trend was one sided or had dual both sides movement.

A Strength Candle as above is the one that has the potential to give direction of the trend and is one of the criteria for Breakout.

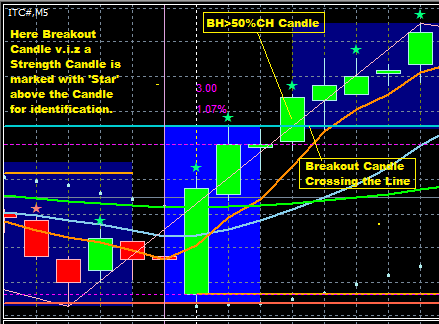

A Breakout typically must have a Strength Candle crossing the Breakout Line and hence these strength candles are also referred as Breakout Candles.

For Intraday Trading on 5min chart we shall look for two such consecutive Breakout Candles for Breakout Confirmation above Open Range as in pic.

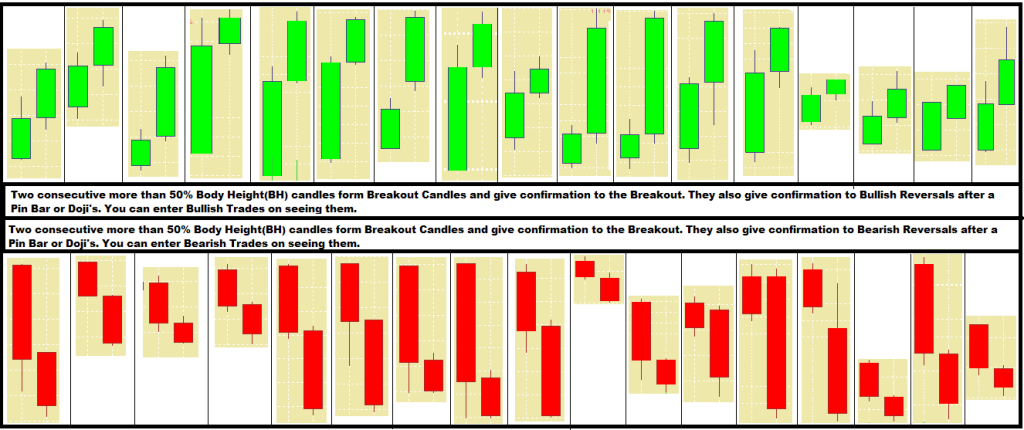

The two consecutive BH>50%CH Breakout Candles can also be used to detect change in trend direction depending where they are formed either at respective High or Low.

In the pic, the two consecutive BH>50%CH Breakout Candles can detect change in trend direction when formed at the Bottom.

Train one’s eyes to detect and spot the two consecutive BH>50%CH candles on the upside as well as down side at High or Low with the following pic .

Particularly in each of these candles notice the Body Height is more than 50% of the Candle Height.

Comments, clarifications are welcomed.

Leave a Reply